About

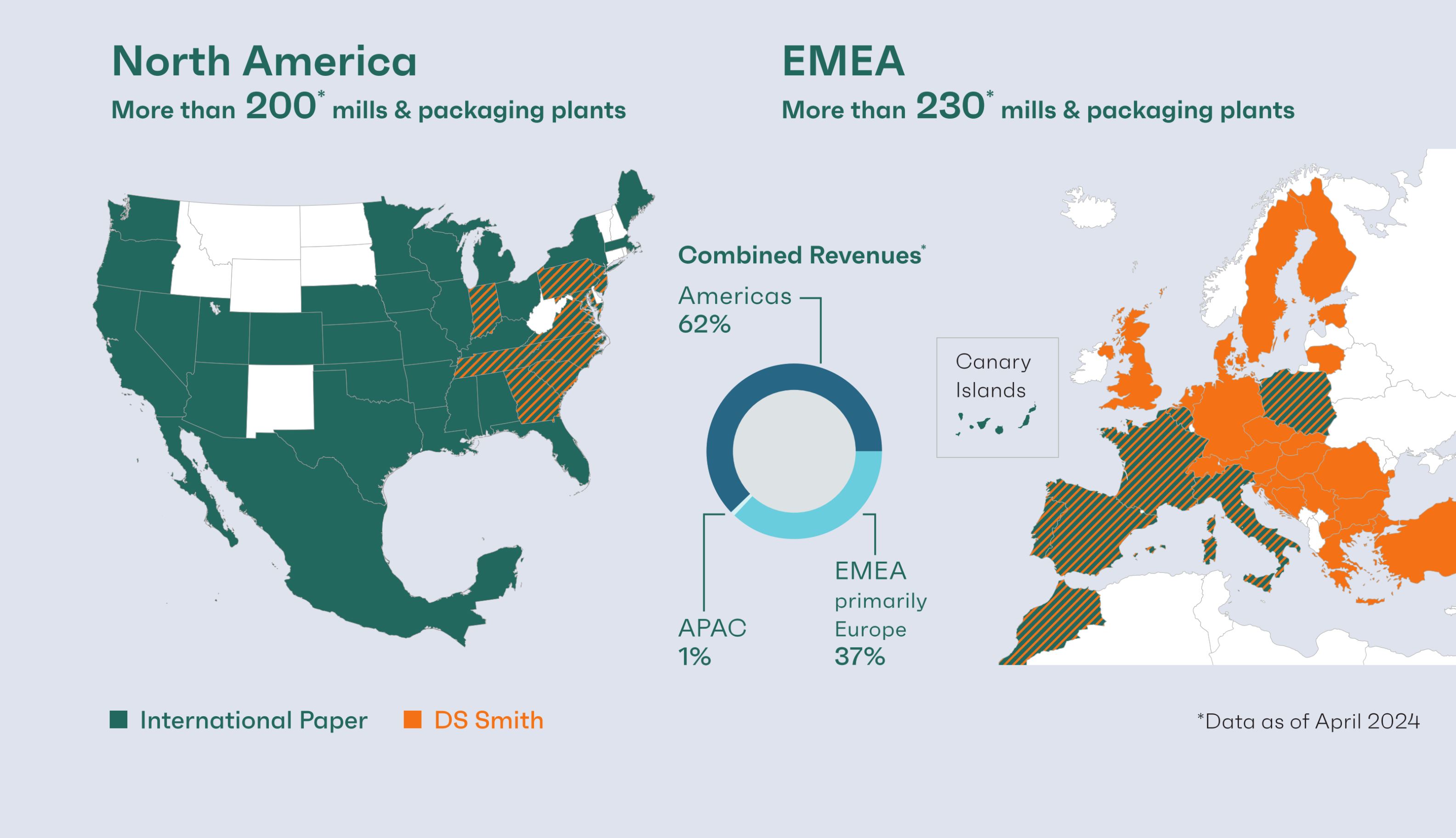

International Paper and DS Smith, two of the leading producers of sustainable packaging and other fiber-based products, combined in January 2025 to create a truly global leader in sustainable packaging solutions.

Building a stronger global company

Together with International Paper, we are the global leader in sustainable packaging. Headquartered in Memphis, Tennessee, USA and London, England, we employ more than 65,000 colleagues with manufacturing operations in North America and Europe, Middle East and Africa (EMEA). Together with our customers, we make the world safer and more productive, one sustainable packaging solution at a time.

Learn more about the International Paper and DS Smith combination

DS Smith was founded in the 1940s as a box-making business in East London, United Kingdom. Since then, the we have expanded to provide full solutions including recycling and paper making, becoming a leading sustainable packaging supplier in Europe. Today, we have operations in more than 30 countries.

International Paper was established in 1898 as a paper and pulp company in the northeastern part of the United States, combining several small businesses. Over the last 125 years, the company has transformed itself multiple times, diversifying and re-focusing, ultimately evolving into a leading global packaging supplier.

OUR CIRCULAR BUSINESS MODEL:

One of our greatest opportunities is to engage our customers on the circular economy, helping some of the world’s leading brands to reach their sustainability goals.

We are recognised around the world for our innovation and for the quality of our packaging. Our products can improve transport and storage efficiency, boost retail presentation and increase product sales for our customers. We are designing out waste and pollution through circular design and helping our customers to replace one billion pieces of plastic with sustainable alternatives. We also play an active role in our local communities and are equipping our people to lead the transition to a circular economy.

It takes two weeks for paper fibre to move around our operations. What does this journey look like? Our Box to Box in 14 Days video follows the fibre on its journey around the DS Smith Supply Cycle.